Written in collaboration with Kelan Stoy

More than 6 months into the COVID-19 crisis, the pressure placed on rental markets by widespread unemployment and the economic strains of the pandemic is clear. The job losses or income reduction impacting millions of American households have left many unable to pay rent, placing them in the crosshairs of eviction and homelessness, and increasing financial stress on landlords as their tenants can’t pay. According to the U.S. Census Bureau’s biweekly Pulse Survey, 17% of households have reported being behind on rent payments and 8% have indicated being at risk of eviction, despite federal and state moratoriums on eviction. The stress is disproportionately felt by non-white households, with 22% of respondents of color reporting they were behind on payments, compared to 12% of white, non-hispanic households.

And now, another critical housing question looms - how is the current climate affecting homeowners?

The CARES Act prevents short-term foreclosure risk for homeowners with federally-backed loans - but what happens when the forbearance period expires?

Early in the crisis, the Federal CARES Act introduced a forbearance program allowing homeowners with federally-backed loans, who are impacted by COVID-19, to postpone mortgage payments until they’re able to work again. By permitting them to postpone payments for up to a year, this program prevents short-term foreclosure risk for homeowners with federally-backed loans. The program also specifies that loan servicers cannot require a lump-sum payment after the forbearance period, presumably protecting borrowers from immediate impacts.

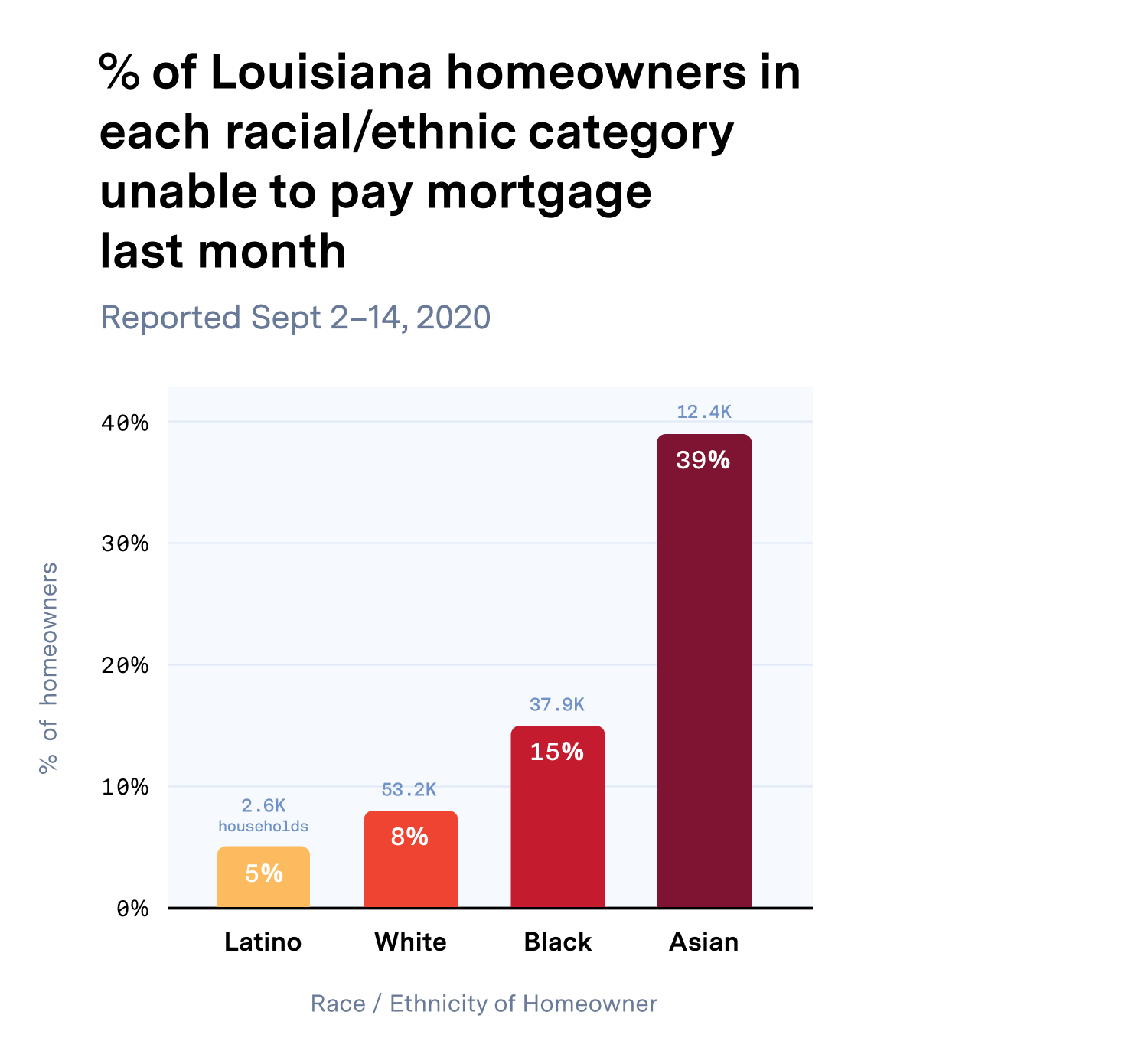

While these federal protections lighten some of the load on homeowners, they may be hiding a growing threat that could adversely impact the larger economy, cities, and communities across the U.S. - and millions of American families. The latest data from mortgage data house Black Knight indicates that, as of September 30, 3.6 million homeowners remain in pandemic-related forbearance plans nationally, representing 6.8% of all active mortgages and $751 billion in unpaid principal. According to the Census Pulse Survey, as of September 14, 17% of lower-income homeowners were behind on mortgage payments. Similar to renters, the crisis is disproportionately impacting communities of color, with 16% of non-white owners behind on payments as of September 14, compared to 8% of white homeowners.

In Louisiana, nearly 110,000 households were unable to pay their mortgage last month - an estimated $140 million gap.

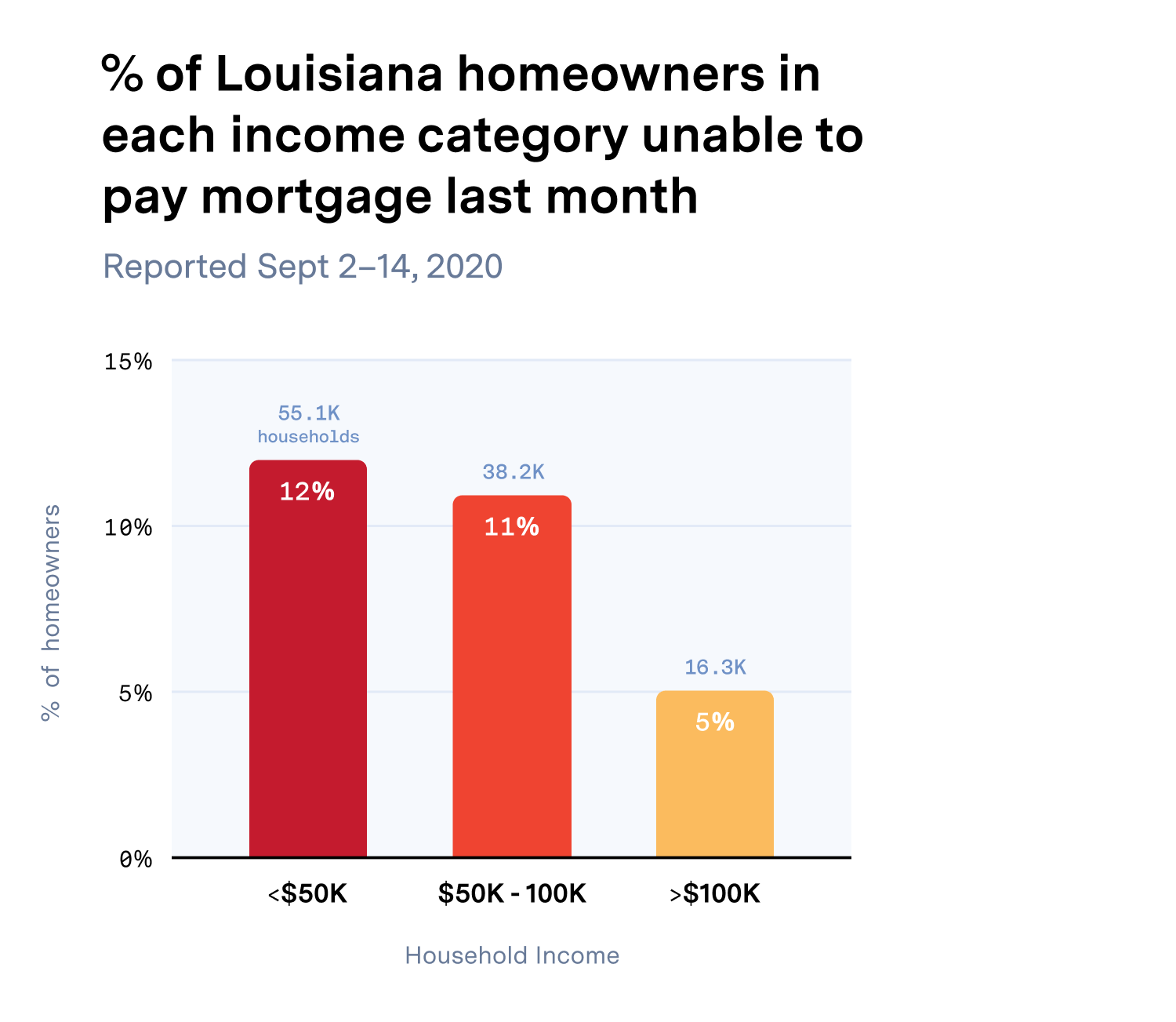

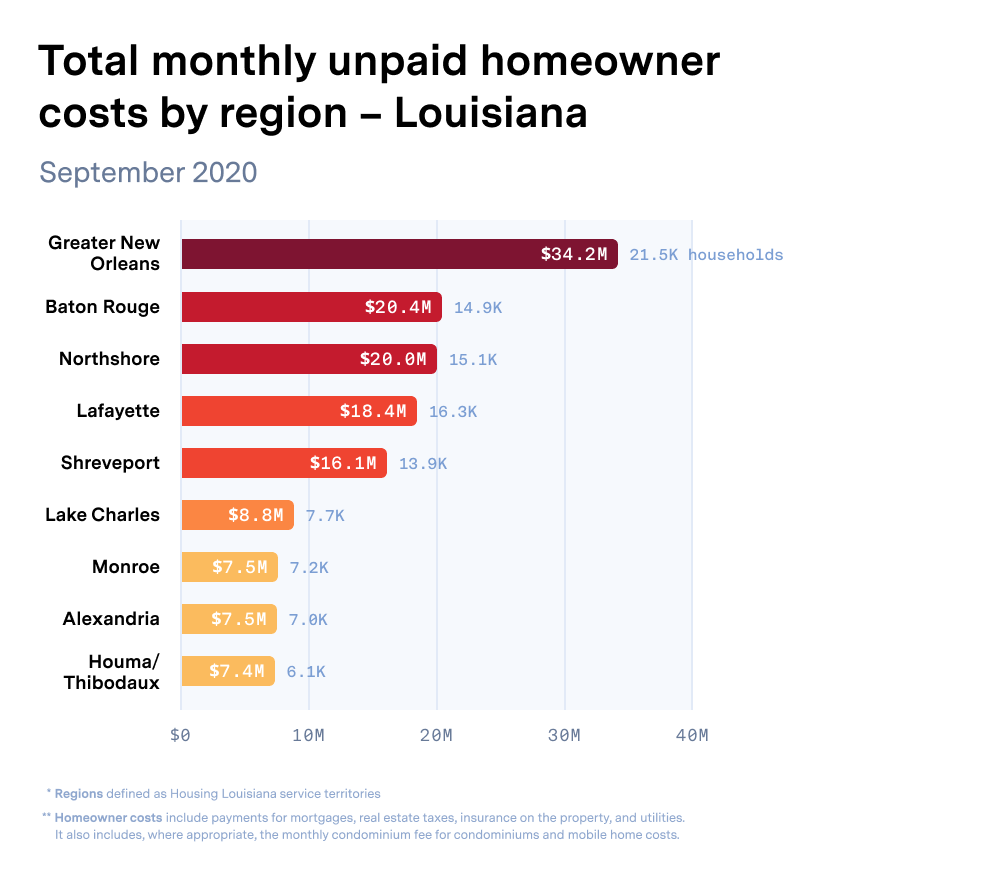

In highly impacted states such as Louisiana, the numbers represent real challenges for tens of thousands of households. Statewide, nearly 110,000 households (10% of owner-occupied households) were unable to pay their mortgage last month, more than 50% of which earn less than $50,000 per year. Similar to the nationwide trend, non-white communities bear disproportionate impact, with a non-payment rate of 14% compared to 8% of white homeowners. Our analysis estimates the mortgage payment gap in Louisiana to be over $140 million per month, a sum that threatens to boil over when CARES Act foreclosure protections expire as early as the first quarter of 2021. It’s also important to note that nearly 30% of home loans nationally are not federally backed and therefore not covered by CARES Act protection.

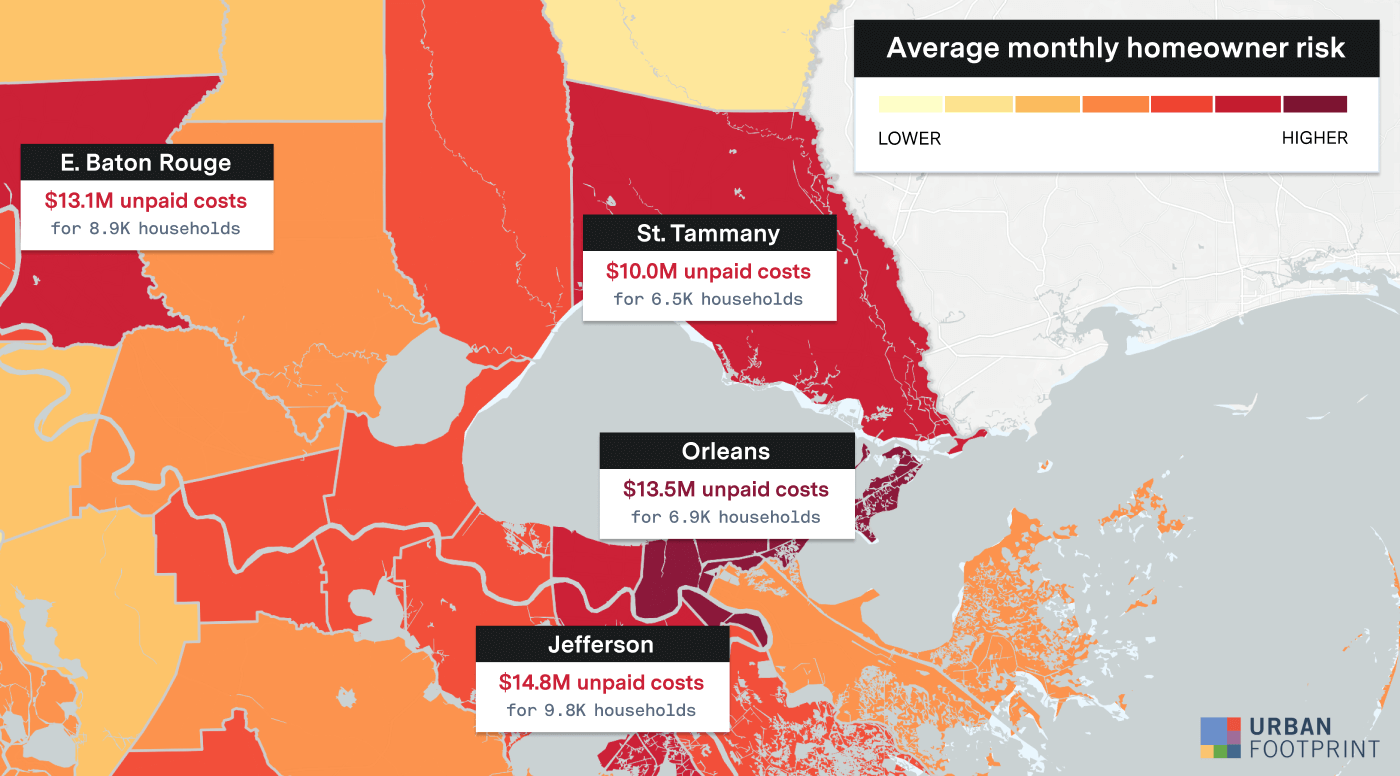

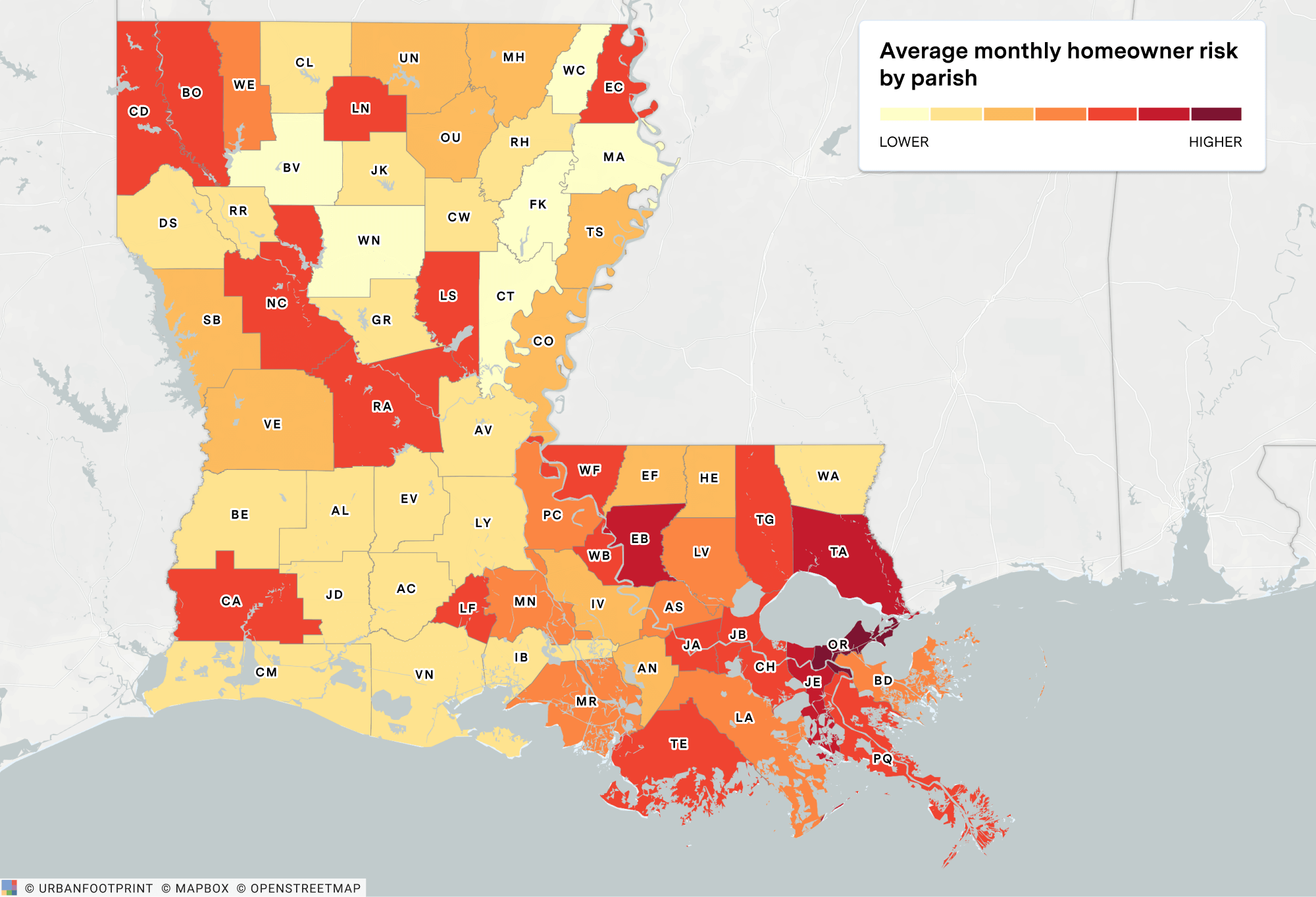

UrbanFootprint’s Homeowner Risk Index indicates that homeowner risk and the mortgage payment gap are concentrated in Louisiana’s urban parishes, with an estimated 36,000 households (nearly 10% of all owner-occupied households) in the New Orleans and Baton Rouge metros unable to pay their mortgage last month. Greater New Orleans is facing a $34 million monthly mortgage gap. Baton Rouge, Lafayette, and Northshore homeowners are estimated to be more than $20 million behind in monthly payments in each metro, totaling nearly $60 million per month.

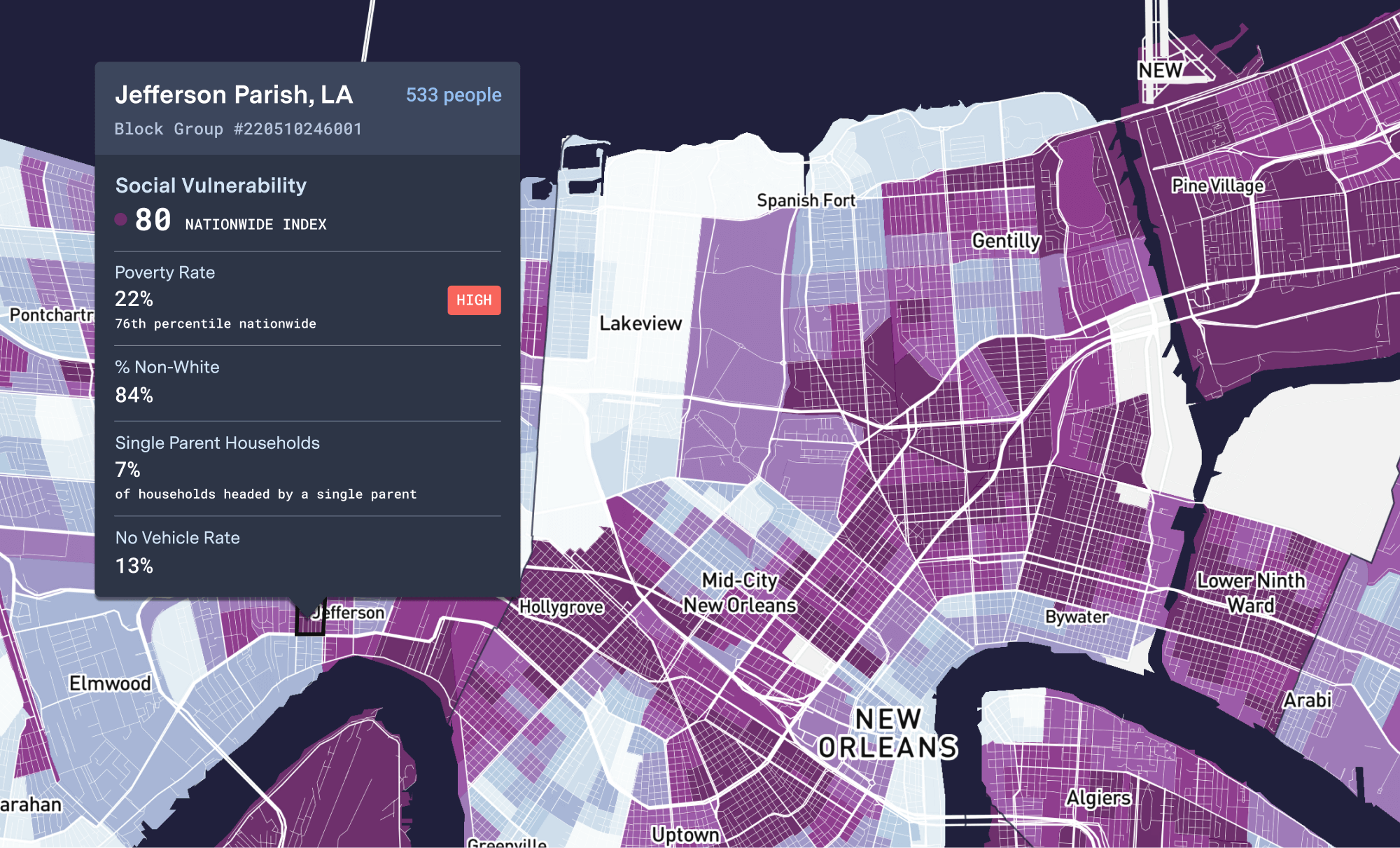

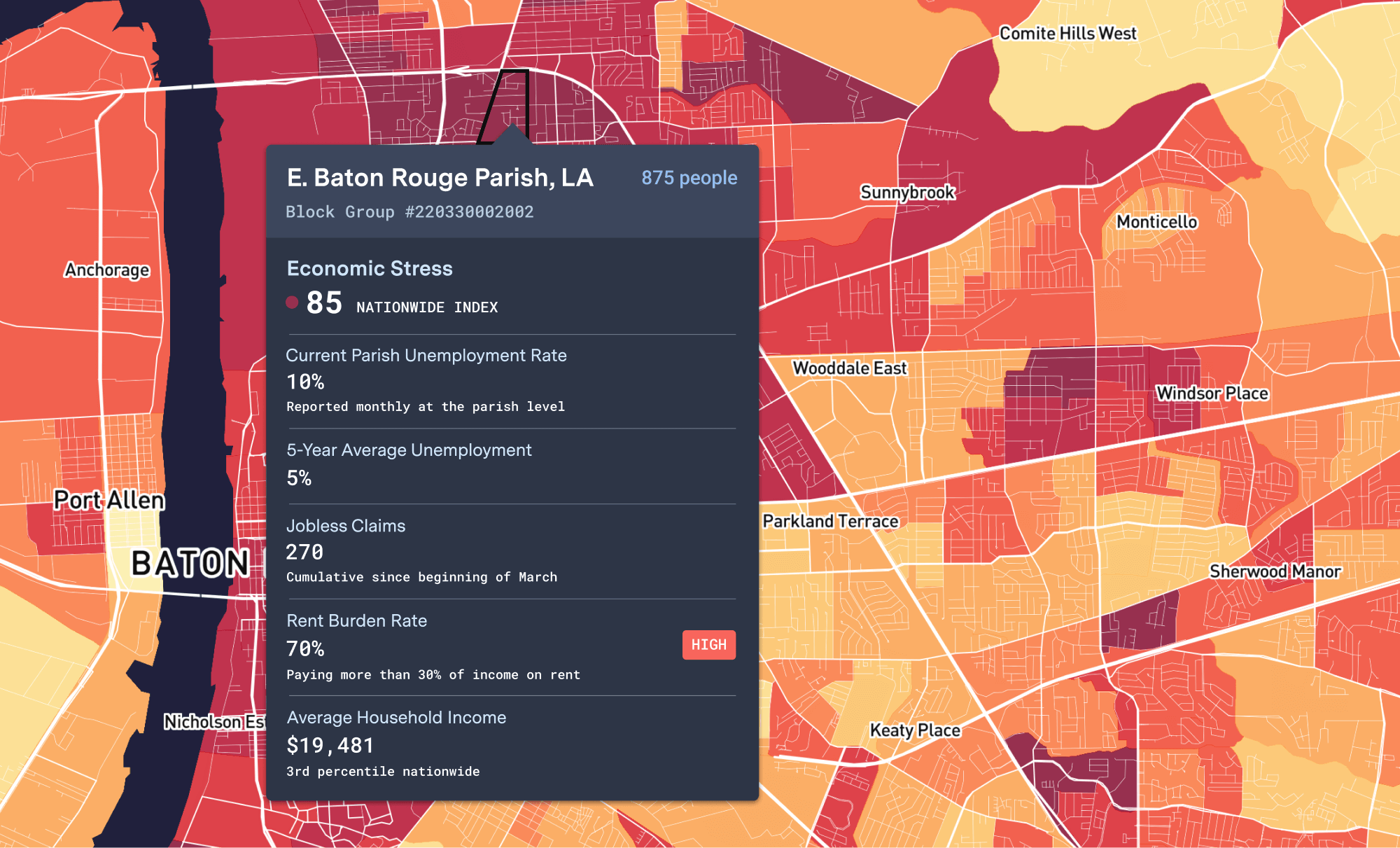

Like rental stress and eviction risk, homeowner risk and mortgage stress is concentrated in communities with high levels of socio-demographic risk factors such as poverty, unemployment, and underlying health conditions. UrbanFootprint’s Social Vulnerability Index illustrates how such risk factors are distributed across the state. The dynamic Economic Stress Index illustrates where economic strain is most concentrated, driven in large part by COVID-related job loss and unemployment.

Communities with high levels of underlying vulnerability are the least resilient to economic stress. Homeowner risk and mortgage non-payment is more highly concentrated in such communities because households there are less likely to have savings or financial resources to weather an economic downturn or job loss.

Location data can help public agencies map where aid is needed most and provide much needed insight to drive more effective policy interventions

The UrbanFootprint Rental Stress and Homeowner Risk Indices provide a dynamic view of the evolving social and economic landscape across the country, and highlight how the COVID-19 crisis has compounded challenges in many communities across America. These indices support public agencies and organizations in developing policy and prioritizing resource distribution and interventions where they’re needed most.

Have a question? Get in touch to learn more about UrbanFootprint’s Rental Stress and Homeowner Risk data.